Key Highlights Pilar Gold Mine

- 172,000 ounces of gold in Proven and Probable Reserves, up 310% compared to 2014

- Proven and Probable gold grade of 4.39 g/t increased 63% compared to 2014

- 514,000 ounces of gold in Measured and Indicated Resources, up 56% compared to 2014

- Significant increase to life of mine to the end of 2019 at current production levels

- Latest drilling results and improved block modeling have confirmed three significant mineralized banded iron formations (BA, BF, and BFII)

- 2016 definition drill program is planned with 10,725 metres (61 holes) from underground

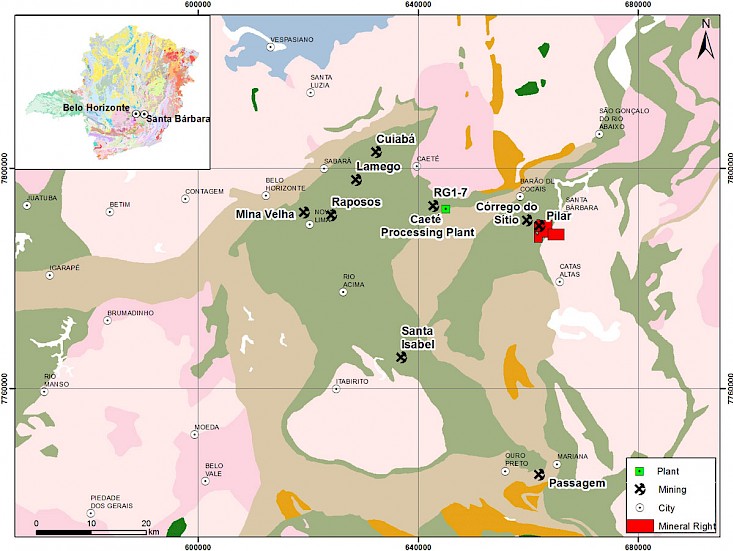

Toronto, Canada, March 04, 2016 - Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX-V: JAG) is pleased to report its 2015 year-end mineral resource and mineral reserve estimate for its wholly owned Pilar Gold Mine ("Pilar") prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). Pilar is an underground gold mine and is part of the Caeté Gold Complex that also includes the underground Roça Grande gold mine and a mill operation that processes ore from both mines. The Caeté Complex is located in the municipalities of Caeté and Santa Bárbara, respectively, in the state of Minas Gerais, Brazil and is approximately 100 kilometres from Belo Horizonte, the capital city of the state of Minas Gerais (see Figure #1).

Pilar Gold Mine Mineral Resource and Reserve Estimates as of December 31, 2015

(see Tables 1 - 4 below for more detail).

Proven & Probable Reserves: 1,220 million tonnes grading 4.39 g/t Au, containing 172,000 oz Au

Measured & Indicated Resources: 3,479 million tonnes grading 4.59 g/t Au, containing 514,000 oz Au

Inferred Resources: 1,208 million tonnes grading 5.45 g/t Au containing 212,000 oz Au

Rodney Lamond, President and CEO of Jaguar Mining stated, "We are extremely pleased with the increased Mineral Resources and Mineral Reserves at Pilar. With the positive results from our drill programs and our improved modeling practices at Pilar, we now have a better understanding of the geological model and its down-plunge mineralization potential. In addition, the new block model has increased our confidence in our Mineral Resources and Reserves inventory. Our priority of building confidence in our mine planning begins with the confidence in our actual Mineral Reserves. The large increase in our Mineral Reserve base at Pilar has enabled us to significantly increase our mine life with sufficient mineral reserves for four years at the current production profile. The Inferred Mineral Resource at Pilar also now confirms that mineralization continues down-plunge on the main mineralized trends and highlights the considerable potential for further additions to our Mineral Resource base."

Mr. Lamond continued, "We are also pleased that our latest drill program has encountered wider mineralized structures at depth, particularly on BF and BFII formations, resulting in a significant increase in the number of ounces per vertical metre. Our drilling has achieved encouraging results, however more drilling is needed on the BA, BF, and BFII Formations. A drill program consisting of 10,725 metres is planned for 2016 to explore and infill drill the down-plunge extensions of these iron-banded formations, with the key intent to build and strengthen our mine model for future development."

The Mineral Resource and Reserve estimates were prepared by Jaguar Mining under the supervision of Jason Cox, P.Eng., and Reno Pressacco, P.Geo. of Roscoe Postle Associates Inc. ("RPA"). RPA is an independent mining consultant and each of Messrs. Cox and Pressacco are Qualified Persons within the meaning of NI 43-101. The effective date of the estimates is December 31, 2015. An independent technical report documenting the mineral resource estimates prepared in accordance with NI 43-101 will be filed on the System for Electronic Document Analysis and Retrieval (SEDAR) within 45 days of the date of this news release.

Pilar Gold Mine Exploration Program Drilling Results

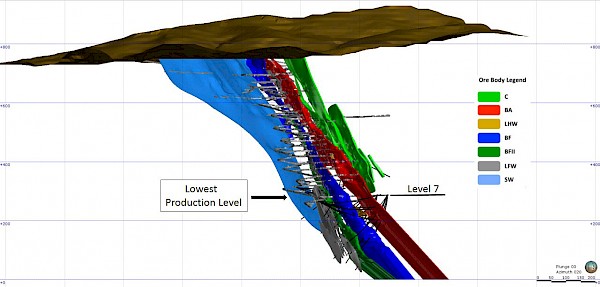

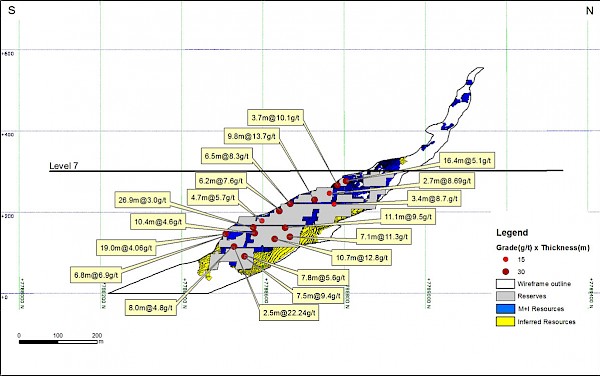

As shown in Figure #2 below, the drill program encountered three significant mineralized banded iron formations (BA, BF, and BFII). The BA mineralization and grade appears to be dropping off at depth, however the footwall flank of the BF and both the footwall and hanging wall flanks of the BFII unit are in fact increasing in grade at depths below the active areas currently being mined. Please refer to news releases dated August 17, 2015 and April 27, 2015 for previous Pilar Mine drill results.

While the drilling results are very encouraging, more drilling is needed on the BA, BF and BFII formations to upgrade the Mineral Resources into the Measured and Indicated Resource categories. A 10,725 metre drill program (61 holes) is planned for 2016. This drill program will target infill drilling of the down-plunge extensions of these iron-banded formations.

Updated Pilar Gold Mine Mineral Reserves and Mineral Resources

For the December 31, 2015 estimates, a new geological and block model was built under the supervision of RPA. Previously, annual estimates were internally reviewed. This year's estimates will be included in the first NI 43-101 Technical Report filed with SEDAR since March 21, 2010 for Pilar.

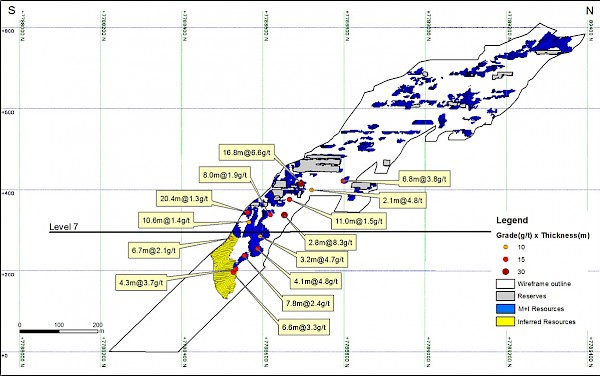

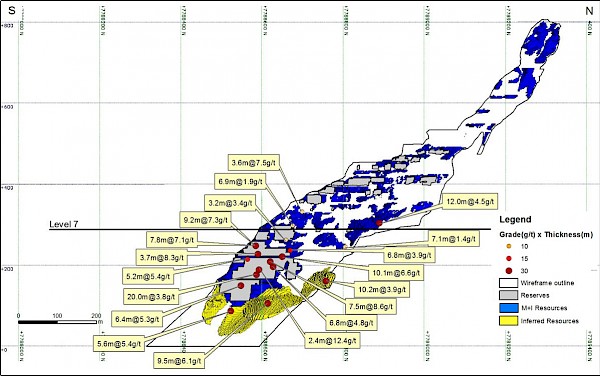

As a result of the 2015 diamond drilling campaign and improved modeling practices, the new reserve report includes a 310% increase in total reserves to 172,000 ounces (1,220,000 tonnes at an average grade of 4.39 g/t Au). The 310% increase in reserves compared to the previous year's estimate of 42,000 ounces (488,000 tonnes at an average grade of 2.70 g/t Au) exceeded the Company's target of replacing reserves mined in 2014 and establishing a significant increase in M&I resources mainly below mine level 7 (see Figures #3, 4 and 5 below).

The database, used to prepare the estimates, with a cut-off date of August 31, 2015, comprises 984 drill holes and 16,445 channel samples. The estimate was generated from a block model constrained by three dimensional (3D) wireframe models. A capping value varying from 10 to 60 g/t Au was applied for all eight "Ore Bodies". The wireframe models of the mineralization and excavated material for Pilar were constructed by Jaguar and reviewed by RPA. A separate wireframe was built for each "Ore Body" and was used to constrain the grade estimates into the block model.

The mineralized material for each "Ore Body" was classified into the Measured, Indicated, or Inferred Mineral Resource categories on the basis of the search ellipse ranges obtained from the variography study, the observed continuity of the mineralization, the drill hole and channel sample density, and previous production experience from these ore bodies.

The Mineral Resources are inclusive of Mineral Reserves. For those portions of the Mineral Resources that comprise the Mineral Reserve, stope design wireframes were used to constrain the Mineral Resource reports. Additional Mineral Resources are present that reside beyond the Mineral Reserves. For these areas, three-dimensional clipping polygons were prepared to aid in the estimation of the Mineral Resources. The clipping polygons were prepared in either plan or longitudinal views, as appropriate. The clipping polygons were drawn to include continuous volumes of blocks whose estimated grades were above the stated cut-off grade, and were not located in mined out areas. The clipping polygons were used to appropriately code the block model and estimate the Mineral Resources. At a cut-off grade of 1.93 g/t Au, the Mineral Resources at Pilar comprise 3.48 million tonnes at an average grade of 4.59 g/t Au containing 514,000 ounces of gold in the Measured and Indicated Resource category, and 1.21 million tonnes at an average grade of 5.45 g/t Au containing 212,000 ounces of gold in the Inferred Mineral Resource category.

Table 1 summarizes the change in Pilar Gold Mine Mineral Reserves from December 31, 2014 to December 31, 2015:

| Pilar Gold Mine - Change in Mineral Reserves | ||||||

|---|---|---|---|---|---|---|

| Gold Ounces (000’s) | Gold Grade (g/t) | |||||

| As at December 31 | 2015 | 2014 | Change (%) | 2015 | 2014 | Change (%) |

| Proven Reserves | 17 | 24 | (33%) | 3.15 | 2.84 | 11% |

| Probable Reserves | 156 | 19 | 721% | 4.58 | 2.54 | 81% |

| Total | 172 | 42 | 310% | 4.39 | 2.70 | 63% |

Table 2 summarizes the change in Pilar Gold Mine Mineral Resources from December 31, 2014 to December 31, 2015:

| Pilar Gold Mine - Change in Mineral Resources | ||||||

|---|---|---|---|---|---|---|

| Gold Ounces (000’s) | Gold Grade (g/t) | |||||

| As at December 31 | 2015 | 2014 | Change (%) | 2015 | 2014 | Change (%) |

| Measured Resources | 97 | 171 | (43%) | 4.25 | 5.97 | (29%) |

| Indicated Resources | 417 | 158 | 164% | 4.68 | 5.32 | (12%) |

| Total - M&I Resources | 514 | 329 | 56% | 4.59 | 5.64 | (19%) |

| Inferred Resources | 212 | 183 | 16% | 5.45 | 5.65 | (4%) |

Table 3 summarizes the Pilar Gold Mine Mineral Reserves as at December 31, 2015:

| Pilar Gold Mine - Mineral Reserves, December 31, 2015 | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Ore Body | Proven Reserves | Probable Reserves | Proven and Probable Reserves | ||||||

| Tonnes | Grade | Gold oz | Tonnes | Grade | Gold oz | Tonnes | Grade | Gold oz | |

| (000's) | (g/t) | (000's) | (000's) | (g/t) | (000's) | (000's) | (g/t) | (000's) | |

| Ore Body BA | 69 | 3.20 | 7 | - | - | - | 69 | 3.20 | 7 |

| Ore Body BF | 64 | 2.95 | 6 | 343 | 4.44 | 49 | 407 | 4.20 | 55 |

| Ore Body BFII | - | - | - | 707 | 4.66 | 106 | 707 | 4.66 | 106 |

| Ore Body LFW | 30 | 3.44 | 3 | - | - | - | 30 | 3.44 | 3 |

| Ore Body LPA | 1 | 3.19 | 0 | 6 | 4.15 | 1 | 7 | 4.00 | 1 |

| Total | 164 | 3.15 | 17 | 1,056 | 4.58 | 156 | 1,220 | 4.39 | 172 |

Notes:

- CIM definitions were followed for Mineral Reserves;

- Mineral Reserves were estimated at a break-even cut-off grade of 2.5 g/t Au;

- Mineral Reserves are estimated using an average long-term gold price of US$1,150 per ounce;

- Mineral Reserves are estimated using an average long-term foreign exchange rate of 3.8 Brazilian Reais: 1 US Dollar;

- A minimum mining width of 2 metres was used;

- Bulk densities used are either 2.89 t/m3 for iron-formation poor domains or 3.05 t/m3 for iron-formation rich domains;

- Numbers may not add due to rounding.

Table 4 summarizes the Pilar Gold Mine Mineral Resources as at December 31, 2015:

| Pilar Gold Mine Measured and Indicated Mineral Resources, December 31, 2015 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ore Body | Measured Resources | Indicated Resources | Total Measured & Indicated Resources | Inferred Resources | ||||||||

| Tonnes | Grade | Gold oz | Tonnes | Grade | Gold oz | Tonnes | Grade | Gold oz | Tonnes | Grade | Gold oz | |

| (000's) | (g/t) | (000's) | (000's) | (g/t) | (000's) | (000's) | (g/t) | (000's) | (000's) | (g/t) | (000's) | |

| Ore Body BA | 293 | 4.09 | 39 | 174 | 5.58 | 31 | 467 | 4.64 | 70 | 65 | 5.13 | 11 |

| Ore Body BF | 259 | 4.57 | 38 | 776 | 4.74 | 118 | 1,035 | 4.7 | 156 | 293 | 6.77 | 64 |

| Ore Body BFII | 4 | 4.46 | 1 | 874 | 5.11 | 144 | 878 | 5.11 | 145 | 198 | 7.89 | 50 |

| Ore Body C | 80 | 4.24 | 11 | 371 | 4.73 | 56 | 451 | 4.62 | 67 | 140 | 5.10 | 23 |

| Ore Body LFW | 68 | 3.82 | 8 | 175 | 4.22 | 24 | 243 | 4.11 | 32 | 117 | 4.87 | 18 |

| Ore Body LFW | - | - | - | 12 | 3.61 | 1 | 12 | 3.61 | 1 | 5 | 3.11 | 0 |

| Ore Body LPA | 6 | 2.72 | 0 | 50 | 3.99 | 6 | 56 | 3.86 | 7 | - | - | - |

| Ore Body SW | - | - | - | 338 | 3.28 | 36 | 338 | 3.28 | 36 | 389 | 3.60 | 45 |

| Total | 709 | 4.25 | 97 | 2,770 | 4.68 | 417 | 3,479 | 4.59 | 514 | 1,208 | 5.45 | 212 |

Notes:

- CIM definitions are followed for Mineral Resources;

- Mineral Resources were estimated at a break-even cut-off grade of 1.93 g/t Au;

- Mineral Resources are estimated using an average long-term gold price of US$1,400 per ounce;

- Mineral Resources are estimated using an average long-term foreign exchange rate of 2.5 Brazilian Reais: 1 US Dollar;

- A minimum mining width of 2 metres was used;

- Bulk densities used are either 2.89 t/m3 for iron-formation poor domains or 3.05 t/m3 for iron-formation rich domains;

- Gold grades are estimated by the Inverse Distance Cubed interpolation algorithm using capped composite samples;

- Mineral Resources are inclusive of Mineral Reserves;

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability;

- Numbers may not add due to rounding.

Figure #1 shows the location of the Pilar Mine:

Figure #2 shows the orientation of the mineralized banded iron formations (view looking north):

Figure #3 shows Ore Body BA distribution of the Mineral Resources and Reserves seen from the hanging wall, as well as the location of the most significant exploration drill hole intersections:

Figure #4 shows Ore Body BF distribution of the Mineral Resources and Reserves seen from the hanging wall, as well as the location of the most significant exploration drill hole intersections:

Figure #5 shows Ore Body BFII distribution of the Mineral Resources and Reserves seen from the hanging wall, as well as the location of the most significant exploration drill hole intersections:

Qualified Persons

The scientific and technical information contained in this press release has been reviewed and approved (i) in respect of the estimated Mineral Reserves and the Life of Mine Plan (LOMP) by Jason Cox, P.Eng., of Roscoe Postle Associates Inc. ("RPA"), and (ii) in respect of the estimated Mineral Resources by Reno Pressacco, P.Geo., of RPA. RPA is an independent mining consultant and each of Messrs. Cox and Pressacco are Qualified Persons within the meaning of NI 43-101.

Quality Control

Jaguar Mining has implemented a quality-control program that includes insertion of blanks, commercial standards and duplicate core samples in order to ensure best practice in sampling and analysis. NQ and BQ size drill core is sawn in half with a diamond saw. Samples are selected for analysis in standard intervals according to geological characteristics such as lithology and hydrothermal alteration contents. Half of the sawed sample is forwarded to the analytical laboratory for analysis while the remaining half of the core is stored in a secure location. Rock channel sampling of the underground development follows the same standard intervals of the drill core. The drill core samples are transported in securely sealed bags to the Jaguar in-house laboratory located at the Roça Grande Mine, Caeté, Minas Gerais. Some samples are also sent for check assaying to the independent SGS Geosol laboratory located in Vespasiano, Minas Gerais. The rock chip samples are transported in securely sealed bags to the Roça Grande Mine Laboratory, Caeté, Minas Gerais. The preparation and analysis are all conducted at the respective facilities, either at the Roça Grande Mine Laboratory in Caeté, Minas Gerais or at the SGS Geosol Laboratory in Vespasiano, Minas Gerais. The Roça Grande Mine Laboratory does not carry an ISO certification. The SGS Geosol Laboratory is ISO 9001 accredited. As part of in-house QA/QC, the Roça Grande Mine Laboratory inserts certified gold standards, blanks and pulp duplicate samples.

About Jaguar Mining Inc.

Jaguar is a gold producer with mining operations in a prolific greenstone belt in the state of Minas Gerais, Brazil. Additionally, Jaguar wholly owns the large-scale Gurupi Development Project in the state of Maranhão, Brazil. In total, the Company owns mineral claims covering an area of approximately 205,000 hectares. Additional information is available on the Company's website at www.jaguarmining.com.

For Further Information Please Contact:

Rodney Lamond

President & CEO, Jaguar Mining

+1 778 788 3743

rodney.lamond@jaguarmining.com

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected", "is forecast", "is targeted", "approximately", "plans", "anticipates" "projects", "anticipates", "continue", "estimate", "believe" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might", or "will" be taken, occur or be achieved. This news release contains forward-looking information regarding the development of the Pilar Gold Mine, the reserve and resource estimates for the Pilar Gold Mine and the assumptions and parameters related thereto, the expected mine life and anticipated gold production. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, assumptions about the availability of financing for exploration and development activities; the estimated timeline for the development of the Pilar Gold Mine; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; and general business and economic conditions. Forward-looking information involve a number of known and unknown risks and uncertainties, including among others the uncertainties with respect to the price of gold, labor disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, procurement and delivery of parts and supplies to the operations, uncertainties inherent to capital markets in general and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent annual information form and management's discussion and analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR at www.sedar.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.